☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to Section 240.14a-12 |

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11 |

| ÷ ÷ ÷ ÷ | 1 |

Notice of Annual Meeting

of Shareholders

To Merck Shareholders:

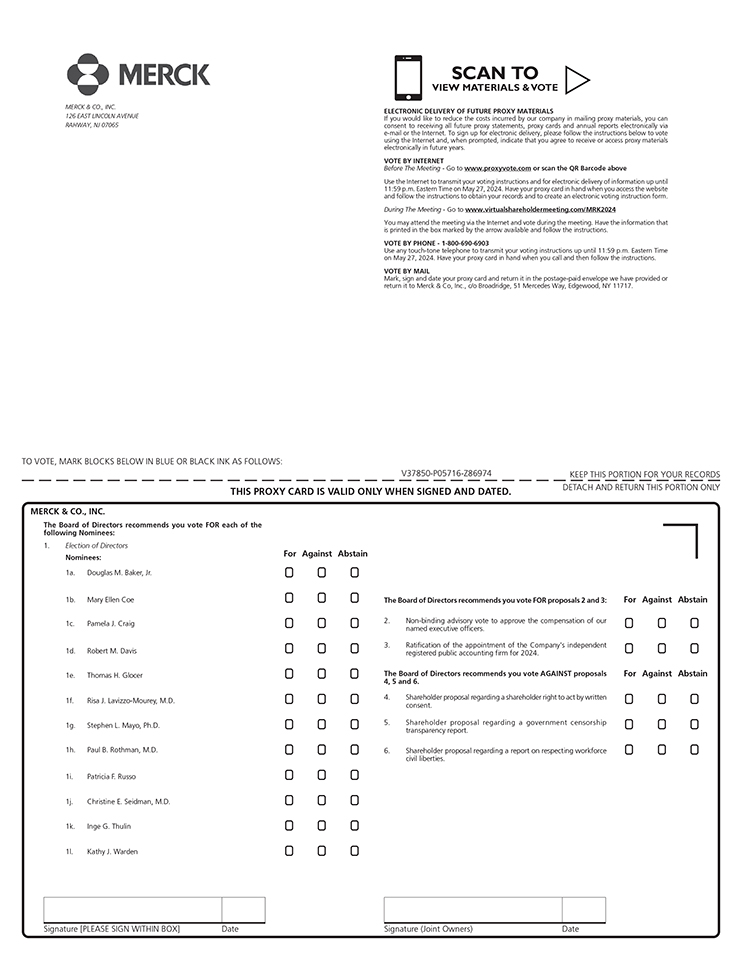

You are invited to the Annual Meeting of Shareholders of Merck & Co., Inc. (the “Company” or “Merck”) on Tuesday, May 23, 2023,28, 2024, at 9:00 a.m. (Eastern Time) via Webcast at www.virtualshareholdermeeting.com/MRK2023.MRK2024 (the “2024 Annual Meeting”).

The purposes of the meeting are to:

1. Elect the 1312 Director nominees named in this proxy statement;

2. Consider and act upon a proposal to approve, by non-binding advisory vote, the compensation of our Named Executive Officers;

3. Consider and act upon a proposal to approve, by non-binding advisory vote, the frequency of future votes to approve the compensation of our Named Executive Officers;

4. Consider and act upon a proposal to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2023;2024;

4. Consider and act upon a shareholder proposal regarding a shareholder right to act by written consent, if properly presented at the meeting;

5. Consider and act upon a shareholder proposal regarding business operations in China,a government censorship transparency report, if properly presented at the meeting;

6. Consider and act upon a shareholder proposal regarding access to COVID-19 products, if properly presented at the meeting;

7. Consider and act upon a shareholder proposal regarding indirect political spending, if properly presented at the meeting;

8. Consider and act upon a shareholder proposal regarding patents and access, if properly presented at the meeting;

9. Consider and act upon a shareholder proposal regarding a congruency report of partnerships with globalist organizations, if properly presented at the meeting;

10. Consider and act upon a shareholder proposal regarding an independent board chairman,on respecting workforce civil liberties, if properly presented at the meeting; and

11.7. Transact such other business as may properly come before the meeting.

By order of the Board of Directors,

Kelly E. W. Grez

Corporate Secretary

Vote Right Away—Advance voting methods and deadlines

We encourage all shareholders of record to read this proxy statement with care and vote right away using any of the following methods, even if they intend to attend the 2024 Annual Meeting. In all cases, have your proxy card or voting instruction form in hand and follow the instructions.

| ||||

| BY INTERNET* | www.proxyvote.com | ||

| BY PHONE* | In the U.S. or Canada dial toll-free 1-800-690-6903 | ||

| BY QR CODE |

| ||

| BY MAIL** | Cast your ballot, sign your proxy card and send in our prepaid envelope | ||

Only shareholders listed on the Company’s records at the close of business on

Merck began distributing its Notice of Internet Availability of Proxy Materials, proxy statement, the

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON

The Notice of Annual Meeting of Shareholders, proxy statement and the The principal executive offices of the Company are located at 126 East Lincoln Avenue, Rahway, N.J. 07065 U.S.A.

* The telephone and internet voting facilities will close at 11:59 p.m. Eastern Time on May ** You will need the 16-digit control number included on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials. If your shares are held in a stock brokerage account or by a bank or other nominee, your ability to vote by telephone or over the internet depends on your broker’s voting process. Please follow the directions provided to you by your broker, bank or nominee.

| ||||

Merck & Co., Inc. 2024 Proxy Statement

| 2 | ç ç ç ç |

Dear Merck Shareholders,

2023 was a very strong year for our company as we continued to deliver for all our stakeholders, including patients, society and you, our shareholders. Driven by our purpose of using the power of leading-edge science to save and improve lives around the world, our team worked with urgency, rigor and passion to develop and deliver important scientific advancements. I am confident our science-led strategy, which keeps the patient at the center of everything we do, will enable us to continue driving value creation today and well into the next decade.

Over the last year, we continued to advance our priority programs and took meaningful steps to build one of the broadest and most diversified pipelines in our recent history. We initiated more than 20 Phase 3 studies, which included advancing eight novel candidates. In 2024, we anticipate an even greater number of Phase 3 study starts and multiple data readouts. We also look forward to three potential new product approvals with the promise to provide significant patient benefit.

In oncology, September 2024 marks a decade since the first approval of KEYTRUDA, a foundational medicine for the treatment of certain types of cancer, currently approved by the U.S. Food and Drug Administration (FDA) for 39 indications across 17 different tumor types. We are committed to continuing to provide important innovation to patients and maintaining our leadership in oncology. Our strong, diverse oncology pipeline includes candidates spanning immuno-oncology, precision molecular targeting and tissue-targeting agents.

As we continue to realize the potential of KEYTRUDA, we are focusing increasingly on earlier stages of disease, where effective intervention has the potential to improve outcomes. We made progress in 2023 for the treatment of certain patients with non-small cell lung cancer (NSCLC) with FDA approvals for KEYNOTE-091 as well as KEYNOTE-671, which met its dual primary endpoints of event-free survival and overall survival. In January 2024, we announced FDA approval for KEYTRUDA in combination with

“I am confident our science-led strategy, which keeps the patient at the center of everything we do, will enable us to continue driving value creation today and well into the next decade.”

chemoradiotherapy for the treatment of stage III through IVA high-risk, locally advanced cervical cancer, based on the Phase 3 KEYNOTE A-18 trial. In the earlier-stage setting, we and our partner Moderna announced positive three-year recurrent-free survival and distant metastasis-free survival data for our individualized neoantigen therapy, V940, in combination with KEYTRUDA for the adjuvant treatment of certain patients with stage III and IV melanoma following complete resection. Together with collaborators, we also announced FDA approval for KEYTRUDA in combination with Padcev, a treatment for adult patients with locally advanced or metastatic urothelial cancer.

We’re making progress with our precision molecular targeting and tissue targeting oncology molecules. The FDA approval of an additional indication for WELIREG, our HIF-2a inhibitor for the treatment of adults with advanced renal cell carcinoma following a PD-1 or PD-L1 inhibitor and a VEGF-TKI, marks the first approval in a novel therapeutic class for this population in nearly a decade. In addition, we showed meaningful progress in our robust oncology pipeline, initiating Phase 3 trials for four investigational medicines, including bomedemstat (LSD1 inhibitor), nemtabrutinib (BTK inhibitor), MK-2870 (anti-TROP2 antibody-drug conjugate, or ADC) and MK-5684 (CYP11A1 inhibitor). We have built a pipeline of ADCs through our collaborations with Kelun-Biotech and Daiichi Sankyo as well as our own discovery programs.

Our growing cardiometabolic pipeline is another exciting area of focus, one where we see significant long-term potential. We recently received FDA approval for WINREVAIR (sotatercept-csrk), a first-in-class activin signaling inhibitor biologic for the treatment of adults with pulmonary arterial hypertension (PAH). PAH is a rare, progressive and potentially devastating disease of the blood vessels in the lungs, which has a profound impact on patients’ lives and on their life expectancy. Additionally, we are working to bring this important medicine to patients in the European Union, where we expect regulatory action in the second half of 2024.

Beyond WINREVAIR, promising candidates like MK-0616, a novel oral PCSK9 inhibitor for the treatment of hypercholesterolemia currently in Phase 3 trials, and MK-6024, an investigational GLP-1/glucagon receptor co-antagonist being evaluated for the treatment of metabolic dysfunction-associated steatohepatitis (MASH), currently in Phase 2 trials, reinforce our expectation that we can achieve positive impact for patients and the potential for approximately $15 billion in revenue from medicines to treat cardiometabolic disease by the mid-2030s.

In our vaccines business, worldwide demand for our vaccines for the prevention of certain human papillomavirus (HPV)-related cervical cancers and other diseases – GARDASIL

Merck & Co., Inc. 20232024 Proxy Statement

Dear Merck Shareholders,

|

| |||||

was studied as an add-on to PAH background therapy. We’ve also received encouraging results from the Phase 2b trial evaluating MK-0616, an oral PCSK9 inhibitor for the treatment of hypercholesterolemia. As a result of these positive data, we plan to move to Phase 3 in the second half of this year. Our progress with sotatercept and MK-0616 is also supplemented by strong momentum in other strategic areas including our Factor XI inhibitor, MK-2060, which received fast-track designation from the U.S. Food and Drug Administration (FDA) in August. Based on these most recent data readouts and the progress we’ve made across our pipeline, we are even more confident in our potential to achieve greater than $10 billion in revenue from our cardiovascular program by the mid-2030s.

Oncology products KEYTRUDA, Lenvima, Lynparza and WELIREG are driving key growth for our business, and we remain focused on our expansive oncology research efforts, including moving to earlier stages of disease where there is a higher probability of achieving improved long-term outcomes for patients. In 2022, we continued our momentum, with approvals for KEYTRUDA and Lynparza in additional tumor types and earlier-stage cancers.

In collaboration with Moderna, we announced that KEYTRUDA in combination with mRNA4157/V940, a personalized mRNA therapeutic cancer vaccine, received breakthrough therapy designation from the FDA for adjuvant treatment of certain patients with high-risk melanoma. This follows results demonstrating statistically significant recurrence-free survival in the Phase 2b trial studying the combination, the first demonstration of efficacy for an investigational mRNA cancer treatment in a randomized clinical trial. We believe this combination has great potential for patients. We also recently received approval for KEYTRUDA for adjuvant treatment after resection and platinum-based chemotherapy for certain adult patients with non-small cell lung cancer based on the results of KEYNOTE-091, which represents its seventh indication in earlier-stage cancers. Early lung cancer detection and screening remain an important unmet need. It is our ambition, along with stakeholders, to improve lung cancer screening rates to levels similar to other cancer types, such as breast and colon, where screening programs have been more widely adopted.

We have made substantial progress in advancing our oncology program through our internal R&D and business development, and we believe that our suite of antibody-drug conjugates and small molecules represent greater than $10 billion of commercial potential by the mid-2030s. This excludes additional innovation we are investing in to expand, deepen and extend our current commercial assets, and does not include the personalized mRNA therapeutic cancer vaccine.

Our vaccines business remains a key growth pillar, anchored by our HPV vaccines GARDASIL and GARDASIL 9. We expect our HPV vaccines to continue growing substantially, potentially more than doubling 2021 sales and generating over $11 billion

Merck & Co., Inc. 2023 Proxy Statement

| ÷ ÷ ÷ ÷ | 3 |

and GARDASIL 9 – continues to grow. We are proud of our legacy and leadership in revenue by 2030. Additionally,the prevention of certain HPV-related cancers and diseases, and we are advancingexpect to continue to protect millions more people around the world. Also in vaccines, the FDA granted Priority Review for our population-specific strategy in pneumococcal vaccines. VAXNEUVANCE isbiologics license application for V116. If approved, in infants, children and adultsV116 would be the first vaccine specifically designed to address the serotypes responsible for protection againstapproximately 83% of invasive pneumococcal disease in adults ages 65 and later this year, we look forward to completingolder. We anticipate launching V116 in the Phase 3 clinical trials from our V116 program for the protectionsecond half of adults against pneumococcal disease. In December, Instituto Butantan in Brazil – an organization2024, and we are collaborating with for vaccine development – reported encouraging topline results for its vaccine candidate to prevent dengue, which will help inform future development of our own dengue vaccine candidate, V181, which usesconfident that V116 represents a similar approach with the same antigenic content. In addition, we have begun a Phase 3 trial of our monoclonal antibody to provide passive immunity against respiratory syncytial virus in infants.multibillion-dollar opportunity.

Our Animal Health business remainedachieved solid growth in 2023, driven by balanced performance across both livestock and companion animal products. Our recently announced agreement to acquire the aqua business of Elanco Animal Health will, upon closing, establish Merck Animal Health as a market leader in 2022,this business segment. We are well positioned in Animal Health with consistent,a strong pipeline of livestock and companion animal products, and we expect to achieve above-market growth driven by higher demandover the long term.

Business development remains a priority and an integral element of our science-led business strategy at Merck, and in livestock from2023, we built on our ruminant, poultrystrong track record of identifying and swine products. Salesaccessing the best science to enhance our pipeline and drive long-term growth with several strategic acquisitions and new collaborations. We accelerated our presence in companion animal reflected higher demandimmunology with the acquisition of Prometheus Biosciences, and subsequently initiated a Phase 3 study for tulisokibart (MK-7240), a TNF-like ligand 1A (TL1A) antibody, in patients with ulcerative colitis. We announced a collaboration with Daiichi Sankyo for three potential first-in-class ADCs that provide the BRAVECTO parasiticide lineopportunity to develop meaningful new options for patients with certain types of products. We look forwardcancer and the opportunity to continuing to build our biopharmaceutical and technology offerings and driving growth, innovation and strong performance in Animal Health.

Our business development strategy is helping position Merck for growth well intodeliver the next decadegeneration of precision cancer medicines. We are also excited about our acquisition of Imago BioSciences, which expands our hematology presence. In addition, our 2024 acquisition of Harpoon Therapeutics augmented our oncology pipeline with a novel portfolio of T-cell engagers, including lead

candidate MK-6070, a T-cell engager targeting delta-like ligand 3 (DLL3), which is being evaluated in certain types of small-cell lung cancer and complements our diverse pipelineneuroendocrine tumors.

We remain deeply passionate about the work we do to enable access and product portfolio.have made strategic commitments to ensure a positive impact on global health. In 2022, we executed several important transactions, including the acquisition of Imago Biosciences and collaborations with Orion Corporation, Orna Therapeutics, Moderna Therapeutics and Kelun-Biotech. We will continue to take a disciplined and focused look at opportunities to add novel assets and technologies to our portfolio in 2023.

We are delivering on our longstanding commitment to operating responsibly, and in 2022, we continued to make significant progress across our goals of expanding access to health, developing a diverse and inclusive workforce, protecting our environment, and operating with the highest standards of ethics. We expanded access to our innovative portfolio to ensure Merck’s science advances global health. We are more than halfway toward reachingsurpassed our goal of providingto enable 100 million more people to access to our innovative portfolio globallyof medicines and vaccines – throughthree years ahead of schedule. As a result, we have raised our ambition and set a new goal to enable access for 350 million people. We have implemented several critical strategies solutionsto realize this goal, one of which focuses on collaboration with key financial institutions and partnerships,payers, helping them expand funding options that assist patients and their families with managing out-of-pocket medical costs due to critical illness. Additionally, guided by 2025. In addition, recognizing the ongoing need for multiple approachesour purpose and principles, we continue to treat COVID-19,uphold our long-term commitment of pricing our medicines responsibly.

Internally and across our global enterprise, we continued to accelerate global access to LAGEVRIO throughconsistently invest in our comprehensive supply and access approach.

We continued to cultivatecolleagues, foster a diversepositive and inclusive workforce, implementing critical strategiesworking environment and leveraging our 10 employee business resource groups, which represent the variousimprove representation across all dimensions of diversity that span our company. These groups enhance employee engagement, enable career growth and development, and help ensure we achieve our business objectives. We also made strong progress toward our climate goals and further developed the tools and processes required to reduce our company’s carbon footprint. And, we are committed to conducting ourselves with integrity, fully complying with regulatory requirements.

Our successdiversity. Importantly, in 2022 was underpinned bywomen represented over half of our understanding thatnew hires globally, and 47% of new hires in the workU.S. came from underrepresented ethnic groups. In the U.S., we do has a truly profound effect on global health. Throughout the year,also achieved greater than 99% pay equity for female and male employees, as well as non-white (including Black, Hispanic and Asian employees) and white employees.

In 2024, we continued to build on our legacy of putting patients first, focusing on how we can address unmet medical needs and work to prevent and treat devastating diseases. We will continue to leverage our size, scope and scale to grow and strength to invest inadvance our pipelinepipeline; and capitalize on opportunities that deliverto provide lifesaving and life-changing benefitsmedicines and vaccines to patients worldwide, as well as great returns forworldwide. Ultimately, this will enable us to deliver value to patients, employees, health care professionals, shareholders and all our shareholders. I am deeply inspired by and proud of the progress we’ve made. Still, I am keenly aware that our work is never done and that patients around the world are waiting for the kind of scientific innovation that Merck can uniquely deliver now and well into the future.

In 2022, we also marked the conclusion of a leadership transition as Ken Frazier retired from our company after a distinguished 30-year tenure. Throughout his Merck career, Ken set and exceeded a high bar of excellence in both executive and board leadership. He led with principle, embodied our core values, and made immense contributions to global health.stakeholders. On behalf of our entire company, I want tothe Company and the Board, thank Ken and wish him the best in his next chapter.

Thank you for your confidence andongoing support of our company. We hopeappreciate your partnership and perspectives and encourage you willto participate in the Annual Meeting either by attending virtually or by voting, as promptly as possible, through other alternative means as described in this proxy statement. Your participation is important, so please exerciseexercising your right to vote.

Robert M. Davis Chairman, Chief Executive Officer and President | “ In 2024, we will continue to leverage our size,

|

Merck & Co., Inc. 20232024 Proxy Statement

| 4 |

ç ç ç |

|

A Message from Merck’s Independent Lead Director

Dear Merck Shareholders,

As you read in the letter from our Chairman and CEO, Robert M. Davis, 2022shared in his letter, 2023 was a truly exceptionalvery strong year for the Company as it continued working to fulfill its purpose of using the power of leading-edge science to save and improve lives around the world. This purpose has guided the Company throughout its long history. It also guides my fellow Directors and methe Board in our work overseeing the Company’s affairs and fulfilling our responsibilities.

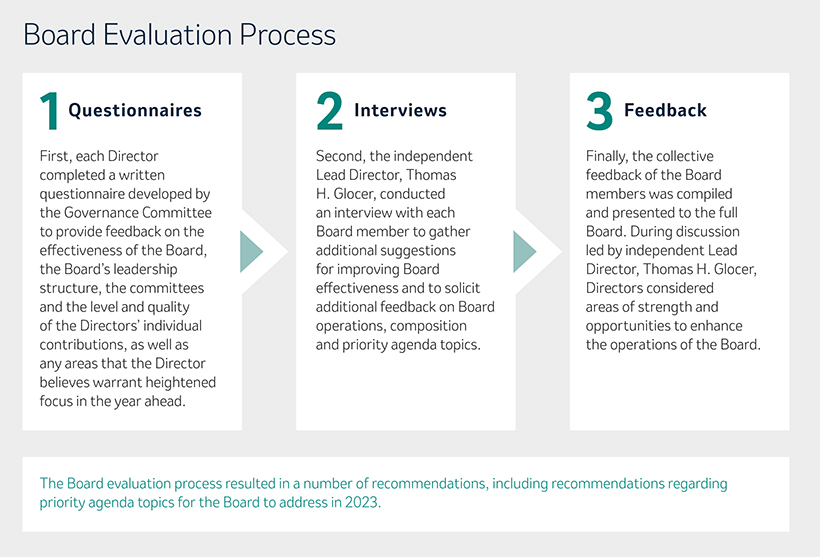

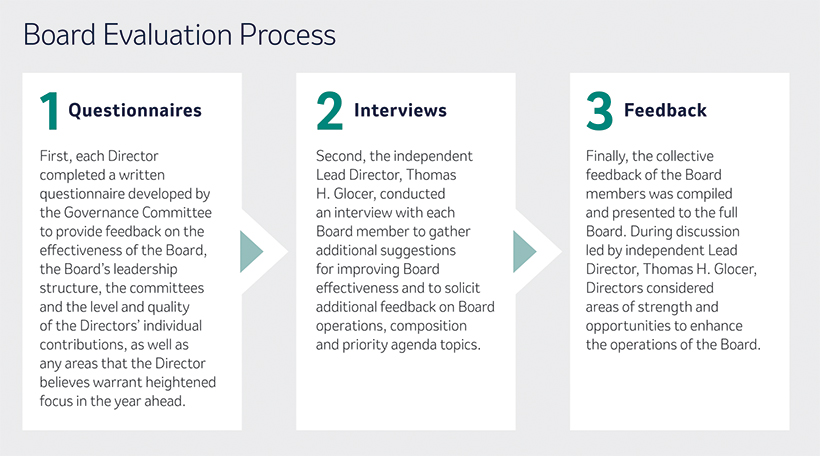

Both as a full Board and through our four standingindependent committees, composed of independent directors only, we are dedicated to the effective oversight of the Company’s strategy and business operations and the key risks the Companyit faces. Our annual self-evaluation process helps us identify ways to continue to enhance the overall effectivenessBoard leadership is an important component of the Board and its committees. It also gives us the opportunity to discuss other important topics through feedback from each of our Directors that is then considered by the full Board.

Part of our annual evaluation process includes aensuring effective oversight. We review of the Board’s leadership structure. Board leadership is a topic considered by the independent Directorsstructure at least annually to ensureconfirm the current structure remains the most appropriate leadership structure for the Company and the Board at a given time. In connection with the Company’s CEO transition in 2021, when the Board unanimously elected Mr. Davis to succeed Kenneth C. Frazier as CEO, and Mr. Frazier’s retirement as Executive Chairman at the end of 2022, in particular, the independent Directors gave significant consideration to the Board’s leadership structure. As independent Lead Director during this period, I led a process with my fellow Directors, working closely with Mr. Davis and Mr. Frazier, that found Rob to be an innovative and strategic leader with a deep understanding of the Company and its industry and well-suited to serve as Chairman of the Board. Effective December 1, 2022, Mr. Davis was unanimously elected by the Board to serve as Chairman.

The Board believescontinues to believe that having Mr. Davis serve as Chairman and CEO provides strategic and operational expertise and perspective to the Chairman role because he can draw on his detailed institutional knowledge of the Company and his industry experience. At the same time, we have strong independent oversight through (a) the key duties and responsibilities I discharge as independent Lead Director and (b) our four independent Board committees chaired by independent Directors. Together, we ensure that Merck achieves the highest level of corporate governance, which includes having diverse perspectives in the boardroom and dialogue with shareholders.

We are deliberate in ensuringBoard composition is, of course, essential to effective oversight. My fellow Directors and I believe that we haveour twelve Director nominees possess broad expertise, skills, experience, and perspectives that will facilitate the right mix of perspectives, skillsstrong oversight and expertisestrategic direction required to addressgovern the Company’s currentbusiness and anticipated needs as opportunitiesstrengthen and challenges facingsupport senior management. To help demonstrate this, and in response to shareholder feedback, this proxy statement includes not only an individualized skills matrix showing the Company evolve. Our Directorskey skills that each Director represents, but also a matrix sharing demographic information for each Director. In fulfilling our board responsibilities, we draw on theirour unique experiences to provide guidance on corporate strategy and monitor its implementation in areas such as research and development, capital allocation, risk management, operating results, human capital management and global manufacturing. The Board also provides oversight

In addition, our annual self-evaluation process helps us identify ways to continue to enhance the overall effectiveness of the Company’s ESG strategyBoard and performance as a whole andour committees. It also gives us the opportunity to discuss other important topics through our committees based on their specific areas of competency. This year, our Compensation and Management Development Committee approved for 2023 a Company Scorecard that will, for the first time, include ESG metrics. Our Company Scorecard helps translate our strategic priorities into operational terms that enable tracking and measurementfeedback from each of our progress and performance against annual operating goals andDirectors that is then considered by the long-term strategic drivers of sustainable value creation. These key objectives include our research and development pipeline and, beginning in 2023, two key strategic ESG priorities of enabling access to the Company’s innovative portfolio to patients around the world and engagement and inclusion of the Company’s employees.full Board.

We appreciate your investment in Merck and your support for the Board. We remain committed to serving you and the patients around the world that depend on Merck’s life-saving work.

|

Thomas H. Glocer Independent Lead Director April |

Merck & Co., Inc. 20232024 Proxy Statement

| ÷ ÷ ÷ ÷ | 5 |

Contents

| Proxy Summary | 6 | ||||||

| Corporate Governance | 11 | ||||||

| 11 | |||||||

| 12 | |||||||

| 13 | |||||||

| 14 | |||||||

| 17 | |||||||

| 18 | |||||||

Board Succession Planning, Criteria for Board Membership, and Director Nomination Process | |||||||

| 22 | |||||||

| 23 | |||||||

| 25 | |||||||

Access and Pricing Transparency for Our Medicines and Vaccines | 26 | ||||||

Political Contributions and Lobbying Expenditure Oversight and Disclosure | |||||||

| Stock Ownership Information | |||||||

| Proposal 1. Election of Directors | |||||||

| Director Compensation | |||||||

| Proposal 2. Non-Binding Advisory Vote to Approve the Compensation of Our Named Executive Officers | |||||||

| Compensation Discussion and Analysis | |||||||

Merck & Co., Inc. 20232024 Proxy Statement

6 | | | | | |

Proxy Summary | ||||||||

|

This summary highlights information contained elsewhere in this proxy statement and does not contain all of the information that you should consider. You should read the entire proxy statement carefully before voting.

Date and Time Tuesday, May 9:00 a.m. ET | Record Date

| |

Location Via Webcast at www.virtualshareholdermeeting.com/

| ||

Voting Matters | Page(s) | Board’s Recommendation | ||||

Proposal 1 Election of Directors | FOR each Nominee | |||||

Proposal 2 Non-binding Advisory Vote to Approve the Compensation of our Named Executive Officers (Say-on-Pay) | FOR | |||||

Proposal 3

| ||||||

Ratification of Appointment of Independent Registered Public Accounting Firm for | FOR | |||||

Shareholder Proposals |

|

| ||||

Proposals Shareholder Proposals | AGAINST | |||||

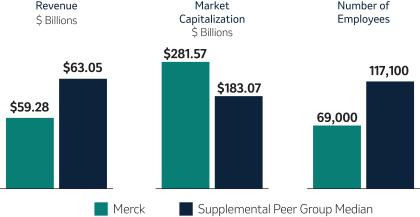

Business Highlights

|

| $ | in total R&D expenses in

|

| |||

Capital Returned & Dividend Increase

|

$ | Capital Returned to Shareholders

|

| |||

Total Shareholder Return(1)

Year-End 2022 | ||

| 1-Year | 3-Year | |

| 48.4% | 12.1% | |

| 5-Year | ||

19.3%

| ||

(1) Relative Total Shareholder Return, a component of our Performance Share Unit program that is described on page 56, is calculated on a different basis.

| ||

Year-End 2023 | ||

| 1-Year | 3-Year | |

| 1.0% | 15.4% | |

| 5-Year | ||

11.7%

| ||

(1) Relative Total Shareholder Return, a component of our Performance Share Unit program that is described on pages 56-57, is calculated on a different basis.

| ||

Merck & Co., Inc. 20232024 Proxy Statement

Proxy Summary | ÷ ÷ ÷ ÷ | 7 |

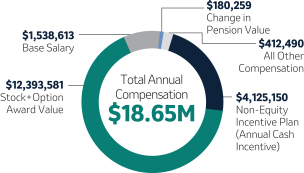

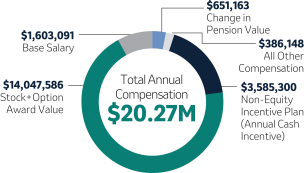

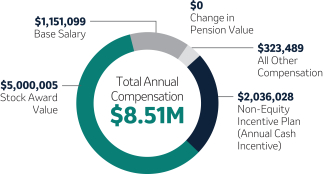

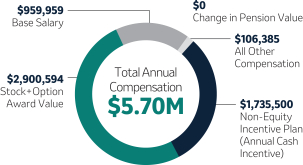

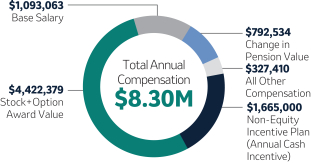

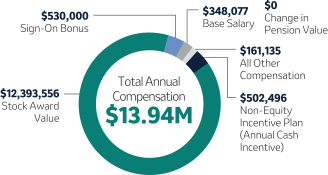

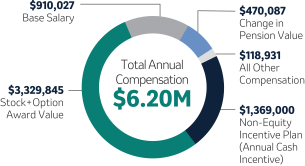

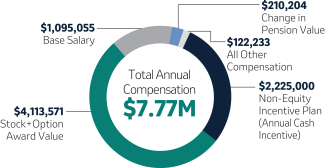

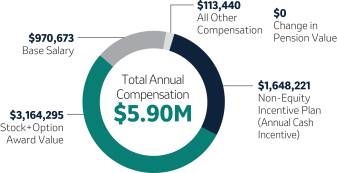

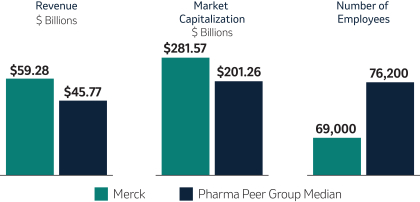

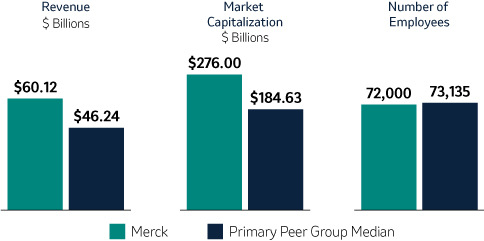

20222023 NEOs and Compensation Highlights (Page 48)50)

Below is a list of our 20222023 Named Executive Officers, or “NEOs”, and select compensation highlights from 2022.2023. For additional information on our elements of 20222023 compensation, please refer to the Compensation Discussion and Analysis (“CD&A”), beginning on page 43.45.

Annual Base Salary$

|

Target Annual Incentive%

|

Target Long-Term

|

Target TDC Increase%(1)

| |||||||||||||||||||||

|

2022 NEOs |

| ||||||||||||||||||||||

|

Robert M. Davis Chairman, Chief Executive Officer and President | $1,545,000 | 150% | $11,750,000 | +7.7% | |||||||||||||||||||

............................................................................................................................................................................. | ||||||||||||||||||||||||

|

Kenneth C. Frazier Former Executive Chairman(5)

| 1,250,000 | 100(2) | 5,000,000 | -43.4 | |||||||||||||||||||

............................................................................................................................................................................. | ||||||||||||||||||||||||

| Caroline Litchfield Executive Vice President and Chief Financial Officer

| 975,000 | 100 | 2,750,000 | +17.5 | |||||||||||||||||||

............................................................................................................................................................................. | ||||||||||||||||||||||||

| Chirfi Guindo Chief Marketing Officer, Human Health

| 700,000 | 80 | —(3) | —(4) | |||||||||||||||||||

............................................................................................................................................................................. | ||||||||||||||||||||||||

| Dean Li, M.D., Ph.D. Executive Vice President and President, Merck Research Laboratories

| 1,250,000 | 100 | 3,900,000 | +30.6 | |||||||||||||||||||

............................................................................................................................................................................. | ||||||||||||||||||||||||

| Jennifer Zachary Executive Vice President and General Counsel

| 974,702 | 95 | 3,000,000 | +7.8 | |||||||||||||||||||

Annual Base Salary$(1)

|

|

Target Annual Incentive%

|

|

Target Long-Term

|

|

Target TDC Increase%(2)

| ||||||||||||||||||

|

2023 NEOs |

| ||||||||||||||||||||||

|

Robert M. Davis Chairman, Chief Executive Officer and President | $1,615,000 | 150% | $13,500,000 | +12.3% | |||||||||||||||||||

............................................................................................................................................................................. | ||||||||||||||||||||||||

|

Caroline Litchfield Executive Vice President and Chief Financial Officer

| 1,125,000 | 100 | 4,250,000 | +38.3 | |||||||||||||||||||

............................................................................................................................................................................. | ||||||||||||||||||||||||

| Sanat Chattopadhyay Executive Vice President and President, Merck Manufacturing Division

| 941,806 | 100 | 3,300,000 | —(3) | |||||||||||||||||||

............................................................................................................................................................................. | ||||||||||||||||||||||||

| Richard R. DeLuca, Jr. Executive Vice President and President, Merck Animal Health

| 925,000 | 100 | 3,200,000 | +7.4(3) | |||||||||||||||||||

............................................................................................................................................................................. | ||||||||||||||||||||||||

| Dean Li, M.D., Ph.D. Executive Vice President and President, Merck Research Laboratories

| 1,400,000 | 100 | 5,600,000 | +31.3 | |||||||||||||||||||

| (1) | Reflects base salary as of December 31, 2023. |

| (2) | Target Total Direct Compensation (“TDC”) is defined as the sum of annual base salary, target annual cash incentive and target long-term incentive. This column reflects the increase in Target TDC from |

| (3) | Mr. Chattopadhyay was not an NEO in |

|

|

|

|

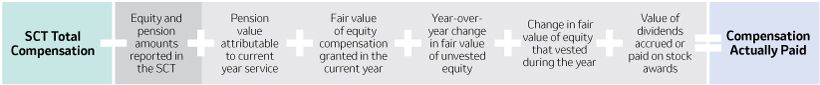

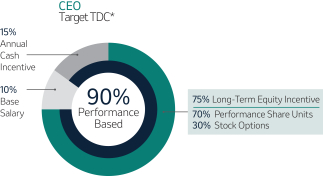

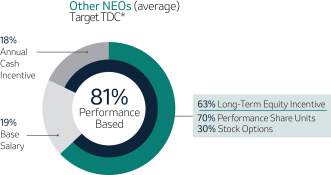

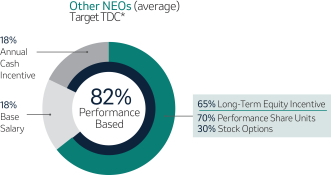

Variable Compensation is Critical to Achieve Our Objectives (Page 51)53)

Merck’s compensation programs are designed to align the interests of our executives with the interests of our shareholders, among other objectives. For this reason, a significant portion of our NEOs’ pay is variable and at-risk, subject to Company performance as measured against financial, operating and strategic objectives, as well as Relative Total Shareholder Return or R-TSR (as defined in Appendix B). The Company’s variable incentives continue to demonstrate a strong linkage between pay and performance.

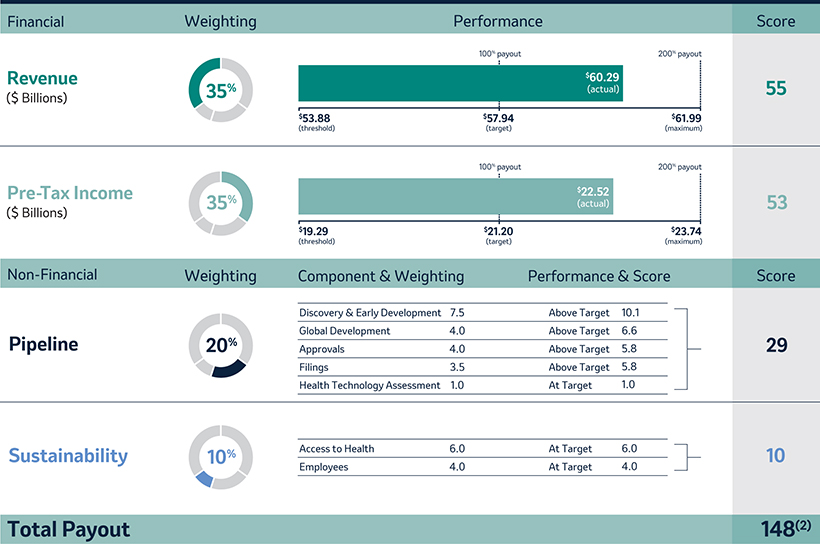

Annual Cash Incentive

The Company Scorecard (described in more detail on page 53)55) focuses on our most critical business drivers — the Company’s revenue (“Revenue”), non-GAAP pre-tax income (“Pre-Tax Income”) and, the Company’s research and development goals (“Pipeline”), and the Company’s focus on driving greater access to health for patients around the incentive programworld and on the engagement and inclusion of our employees (“Pipeline”Sustainability”) — and is used to determine the payout of our annual incentive for all eligiblemost employees, including our NEOs under the Executive Incentive Plan. Our Company Scorecard performance during 20222023 resulted in above-target achievement of 178%148%.

Merck & Co., Inc. 20232024 Proxy Statement

| 8 |

ç ç ç |

Proxy Summary |

Long-Term Incentive (“LTI”)

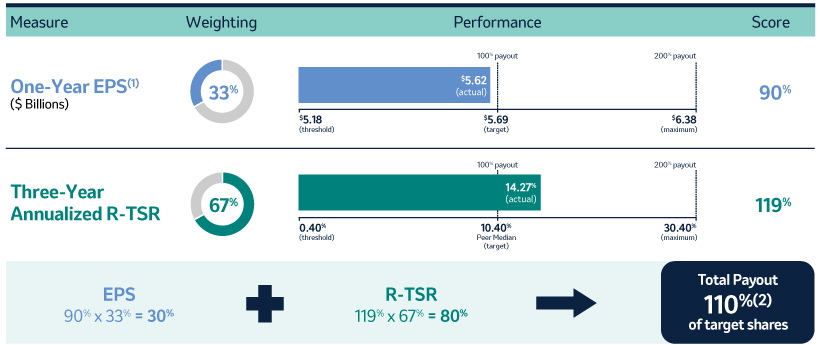

The long-term incentive program, consisting of a mix of Performance Share Units (“PSUs”) and stock options, provides our NEOs with the opportunity to own Merck common stock, directly linking a substantial portion of their compensation to the returns realized by our shareholders.

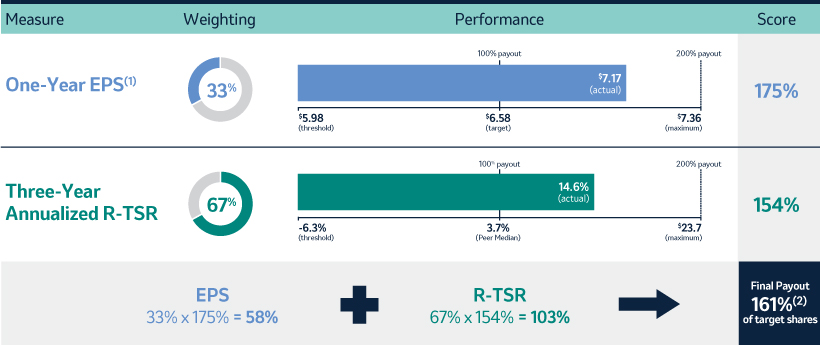

The 20202021 PSU program (described in more detail on page 57)58) paid out at 110%161% based on achievement of one-year Earnings Per Share (“EPS”) and three-year R-TSR metrics during the performance period (2020-2022)(2021-2023), weighted at 33% and 67%, respectively. As previously disclosed, one-year EPS was used due to the complexities associated with disentangling our Organon & Co. (“Organon”) business from a multi-year financial plan. Organon was successfully spun off in June 2021.

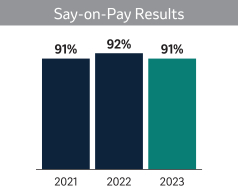

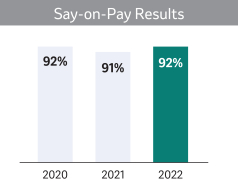

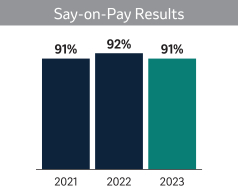

| Say-On-Pay Advisory Vote (Page |

| |

| In |

We ask that our shareholders approve, on an advisory basis, the compensation of our NEOs as further described in Proposal 2 on page 42. This year, we are also asking shareholders to cast a non-binding, advisory vote on the frequency of future votes to approve the compensation of our NEOs. Shareholders will be able to specify one of four choices for this proposal on the proxy card; one year, two years, three years or abstain. The Board believes that it is appropriate and in the best interest for our shareholders to continue to cast a non-binding, advisory vote on the compensation of our NEOs on an annual basis.

44. For additional information, please refer to the CD&A beginning on page 4345 of this proxy statement.

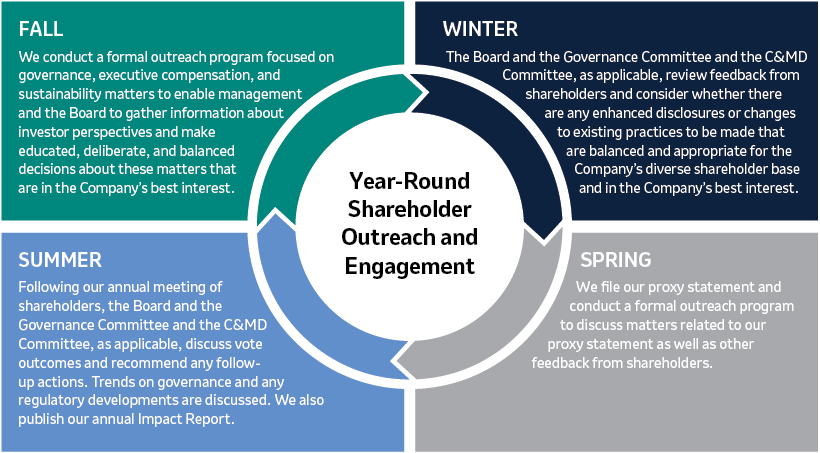

Shareholder Engagement and Feedback (Page 25)24)

Merck communicates regularly with shareholders to better understand their perspectives and has established a shareholder engagement program that is both proactive and cross-functional. In addition, our independent Lead Director, who is also Chair of our Governance Committee, participates in substantive engagements with some of the Company’s largest shareholders. In 2022,2023, discussions with shareholders covered a wide range of topics of interest to shareholders, including Environmental, Social and Governance (“ESG”)sustainability reporting and goals, the Board’s leadership structure and composition, management and director succession, executive compensation programs, human capital management and other governance matters. These discussions provided valuable insights into shareholder views, and we heard from many shareholders that they greatly appreciated the opportunity to engage with our Company.

We will continue to engage with shareholders on a regular basis to better understand and consider their views, including on our ESGsustainability approach, our executive compensation programs and our corporate governance practices.

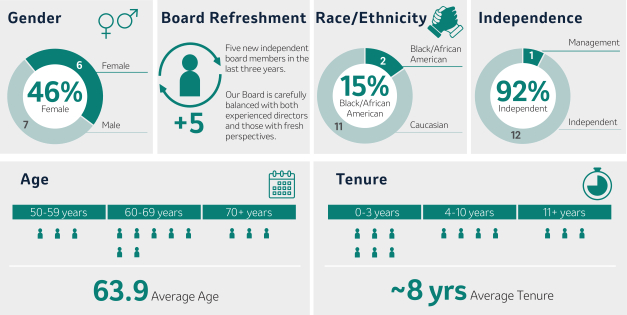

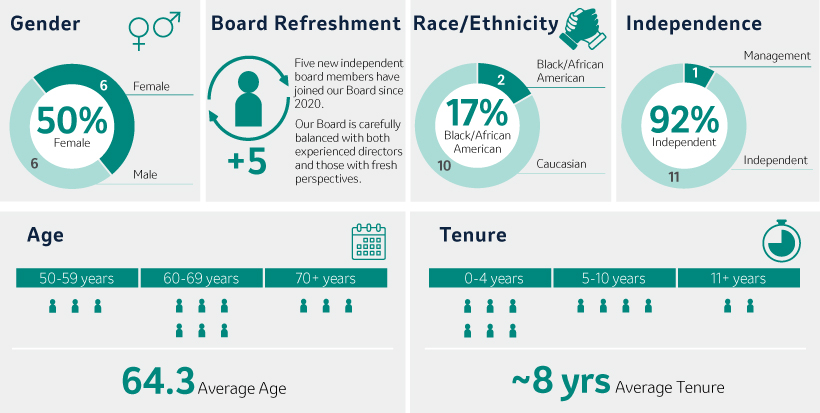

Board Composition and Refreshment

At least annually, the Governance Committee considers the size, structure and needs of the Board. The Governance Committee reviews possible candidates for the Board and recommends Director nominees to the Board for approval. In addition, as part of the Board’s annual self-evaluation process, Directors provide feedback on Board composition-related matters.

In selecting Director nominees, the Board considers its composition, including its diversity, and the skills, areas of expertise and experience then-represented on the Board. The Board also considers the Company’s current and future global business strategies, opportunities and challenges. Such considerations have resulted in the election of five new independent Directors over the last three years.since 2020. For more information, see “Board Succession Planning, Criteria for Board Membership, and Director Nomination Process” beginning on page 21.20. After years of dedicated service, Mr. Peter Wendell will retire from the Board effective as of the 2024 Annual Meeting.

Merck & Co., Inc. 20232024 Proxy Statement

Proxy Summary | ÷ ÷ ÷ ÷ | 9 |

Nominees for Director (Page 33)36)

The following provides summary information about each Director nominee. Each Director stands for election annually. Detailed information about each individual’s background, skillsets and areas of expertise can be found beginning on page 33.36.

| Current Committee Memberships | ||||||||||||||||||||||||||||||||||

| Audit | C&MD | Governance | Research | |||||||||||||||||||||||||||||||

| Director Nominee | Age | Director Since | Title |  |  |  |  | |||||||||||||||||||||||||||

| Douglas M. Baker, Jr. | 64 | 2022 | Former Executive Chairman and Chief Executive Officer, Ecolab Inc. |

|

| ||||||||||||||||||||||||||||

| Mary Ellen Coe | 56 | 2019 | Chief Business Officer, YouTube Inc. |

|

| ||||||||||||||||||||||||||||

| Pamela J. Craig | 66 | 2015 | Former Chief Financial Officer, Accenture plc |

|

| ||||||||||||||||||||||||||||

| Robert M. Davis Management | 56 | 2021 | Chairman, Chief Executive Officer and President, Merck & Co., Inc. | ||||||||||||||||||||||||||||||

| Thomas H. Glocer Lead Director | 63 | 2007 | Former Chief Executive Officer, Thomson Reuters Corporation |

|

| ||||||||||||||||||||||||||||

| Risa J. Lavizzo-Mourey, M.D. | 68 | 2020 | Professor Emerita, Robert Wood Johnson Foundation Population Health and Health Equity, University of Pennsylvania

|

|

| ||||||||||||||||||||||||||||

| Stephen L. Mayo, Ph.D. | 61 | 2021 | Bren Professor of Biology and Chemistry, California Institute of Technology |

|

| ||||||||||||||||||||||||||||

| Paul B. Rothman, M.D.

| 65 | 2015 | Former Dean of Medical Faculty and Vice President for Medicine, The Johns Hopkins University, and Former CEO, Johns Hopkins Medicine

|

|

| ||||||||||||||||||||||||||||

| Patricia F. Russo | 70 | 1995 | Chair, Hewlett Packard Enterprise Company; Former Chief Executive Officer and Director, Alcatel-Lucent

|

|

| ||||||||||||||||||||||||||||

| Christine E. Seidman, M.D. | 70 | 2020 | Thomas W. Smith Professor of Medicine and Genetics, Harvard Medical School, and Director, Cardiovascular Genetics Center, Brigham and Women’s Hospital

|

|

| ||||||||||||||||||||||||||||

| Inge G. Thulin | 69 | 2018 | Former Chairman of the Board, President and Chief Executive Officer, 3M Company

|

|

| ||||||||||||||||||||||||||||

| Kathy J. Warden | 51 | 2020 | Chair, Chief Executive Officer and President, Northrop Grumman Corporation |

|

| ||||||||||||||||||||||||||||

| Peter C. Wendell | 72 | 2003 | Managing Director, Sierra Ventures |

|

| ||||||||||||||||||||||||||||

Number of Meetings in 2022 | 9 | 5 | 4 | 5 | ||||||||||||||||||||||||||||||

| Current Committee Memberships | |||||||||||||||||||||||||||||||||||||

| Audit | C&MD | Governance | Research | ||||||||||||||||||||||||||||||||||

| Director Nominee | Age | Director Since | Title |  |  |  |  | ||||||||||||||||||||||||||||||

| Douglas M. Baker, Jr. | 65 | 2022 | Founding Partner, E2SG Partners; Former Executive Chairman and Chief Executive Officer, Ecolab Inc. |

|

| |||||||||||||||||||||||||||||||

| Mary Ellen Coe | 57 | 2019 | Chief Business Officer, YouTube Inc. |

|

| |||||||||||||||||||||||||||||||

| Pamela J. Craig | 67 | 2015 | Former Chief Financial Officer, Accenture plc |

|

| |||||||||||||||||||||||||||||||

| Robert M. Davis Management | 57 | 2021 | Chairman, Chief Executive Officer and President, Merck & Co., Inc. | |||||||||||||||||||||||||||||||||

| Thomas H. Glocer Lead Director | 64 | 2007 | Founder/Managing Partner, Angelic Ventures LP; Former Chief Executive Officer, Thomson Reuters Corporation |

|

| |||||||||||||||||||||||||||||||

| Risa J. Lavizzo-Mourey, M.D. | 69 | 2020 | Professor Emerita, Robert Wood Johnson Foundation Population Health and Health Equity, University of Pennsylvania

|

|

| |||||||||||||||||||||||||||||||

| Stephen L. Mayo, Ph.D. | 62 | 2021 | Bren Professor of Biology and Chemistry & Merkin Institute Professor, California Institute of Technology |

|

| |||||||||||||||||||||||||||||||

| Paul B. Rothman, M.D.

| 66 | 2015 | Former Dean of Medical Faculty and Vice President for Medicine, The Johns Hopkins University, and Former CEO, Johns Hopkins Medicine

|

|

| |||||||||||||||||||||||||||||||

| Patricia F. Russo | 71 | 1995 | Former Chief Executive Officer and Director, Alcatel-Lucent

|

|

| |||||||||||||||||||||||||||||||

| Christine E. Seidman, M.D. | 71 | 2020 | Thomas W. Smith Professor of Medicine and Genetics, Harvard Medical School, and Director, Cardiovascular Genetics Center, Brigham and Women’s Hospital

|

|

| |||||||||||||||||||||||||||||||

| Inge G. Thulin | 70 | 2018 | Former Chairman of the Board, President and Chief Executive Officer, 3M Company

|

|

| |||||||||||||||||||||||||||||||

| Kathy J. Warden | 52 | 2020 | Chair, Chief Executive Officer and President, Northrop Grumman Corporation |

|

| |||||||||||||||||||||||||||||||

Number of Meetings in 2023 | 9 | 4 | 4 | 4 | |||||||||||||||||||||||||||||||||

Committee Chair

Committee Chair

Merck & Co., Inc. 20232024 Proxy Statement

| 10 |

ç ç ç |

Proxy Summary |

Our 20232024 Director Nominees Snapshot

Our Director nominees possess broad expertise, skills, experience and perspectives that will facilitate the strong oversight and strategic direction required to govern the Company’s business and strengthen and support senior management. As illustrated by the following charts, our slate of Director nominees consists of individuals with expertise in fields that align with the Company’s business and long-term strategy, includes a mixture of tenure that allows for both new perspectives and continuity and reflects the Board’s commitment to diverse perspectives.

Board Skills and Qualifications (of | No. of Nominees* | ||||

CEO Leadership | |||||

Financial | |||||

Scientific / Technology | |||||

| 6 | ||||

Healthcare Industry | 6 | ||||

Global Strategy & Operations | |||||

Marketing / Sales | 4 | ||||

Digital | |||||

Public Company Governance | |||||

Public Policy & Regulation | |||||

Talent Management | 10 | ||||

Capital Markets Experience | |||||

* See page 22 of this proxy statement under Individual Experience, Qualifications, AttributesNominee Skills and SkillsDemographic Matrix for how these Board skills and qualifications are represented by each Director nominee individually.

Merck & Co., Inc. 20232024 Proxy Statement

Corporate Governance |

| |||||||

| | | |

11

|

The Board has the legal responsibility for overseeing the affairs of the Company and for the overall performance of the Company. The Board’s primary mission is to represent and protect the interests of our shareholders. To that end, the Board selects and oversees the senior management team, which is charged with conducting Merck’s daily business.

The Board has adopted corporate governance guidelines (the “Policies of the Board”) that, together with our Restated Certificate of Incorporation, By-Laws and Board committee charters, form the governance framework for the Board and its committees. The Policies of the Board cover a wide range of subjects, including the philosophy and functions of the Board, the composition of the Board, the independent Lead Director’s responsibilities, categorical independence standards, Director qualifications, assessment of the Board, committee responsibilities, Director transition and retirement, service on other boards, Director compensation, stock ownership guidelines, chairmanship of meetings, Director orientation and continuing education, incumbent Director resignation and related person transactions. From time to time, the Board updates the Policies of the Board and Board committee charters in response to changing regulatory requirements, evolving best practices and the perspectives of our shareholders and other constituents.

Governance Materials

The following items relating to corporate governance at Merck are available on our website at www.merck.com/company-overview/leadership/board-of-directors:

| • | By-Laws |

Governance Highlights

We believe good corporate governance is essential to achieving long-term shareholder value. We are committed to governance policies and practices that serve the interests of our Company and its many stakeholders. For this reason, we devote considerable time and resources to making sure that our policies reflect our values and business goals, we have an effective corporate governance structure, and we operate in an open, honest and transparent way. In addition, we evaluate our practices against prevailing best practices as well as emerging and evolving topics identified in a variety of ways, including through shareholder engagement and corporate governance organizations.

Merck & Co., Inc.2023 2024 Proxy Statement

| 12 |

ç ç ç |

Corporate Governance Board Leadership Structure |

We highlight some significant aspects of our corporate governance practices below.

Independence

• We have a strong independent Lead Director.

• Our independent Directors convene regular executive sessions.

• All four of our standing Board committees (Audit, C&MD, Governance and Research) are comprised solely of independent Directors.

•

Accountability

• Every Director stands for re-election every year.

• Directors are elected by majority vote.

• An incumbent director who does not receive a majority vote must tender his/her resignation, and the Governance Committee must promptly make a recommendation as to the tendered resignation. The Board must act on the Governance Committee’s recommendation within 90 days after certification of the vote and publicly disclose its decision and rationale.

Best practices

• Our Board of Directors as a whole, and each Board committee, conducts a self-evaluation every year.

• The Board actively engages in CEO succession planning.

• The Board is diverse in terms of gender, ethnicity,

• Our Board has a written Diversity Policy incorporated into

Transparency

• We have strong control over our political spending and disclose corporate political activity and contributions in the U.S., Canada and Australia.

• We disclose aspects of our public policy engagement, including our key lobbying/advocacy issues.

• We disclose philanthropic grants and charitable contributions in the U.S. | Board oversight

• The full Board and each individual Board committee is responsible for overseeing risk.

• The full Board oversees corporate strategy.

Alignment with shareholder interests

• Our officers and directors are prohibited from engaging in hedging, pledging or short sale transactions involving

• Executives and Directors must hold prescribed meaningful amounts of

• We have a robust shareholder engagement program.

• We have a proxy access provision in our By-Laws under which shareholders who own 3% of our outstanding common stock for at least three years may nominate up to 20% of the members of our Board.

• Holders of 15% of our shares may call a special meeting.

• We do not have a shareholder rights plan (also known as a poison pill).

• We do not have any supermajority voting provisions.

Compensation practices

• We have conducted an annual say-on-pay advisory vote since 2011.

• All incentive compensation paid to executives is subject to a clawback policy.

• Our incentive compensation awards are designed to align pay with performance.

• Our C&MD Committee uses an independent compensation consultant.

Operating Responsibly

• We have a longstanding commitment to operating responsibly.

• All of our employees must adhere to a robust Code of Conduct. |

Board Leadership Structure

Currently, the Board is led by Robert M. Davis, who serves as the Chairman of the Board and CEO of Merck, and by Thomas H. Glocer, an independent Director, who serves as the Board’s Lead Director. The Board believes that the Company and our shareholders are best served by allowing the Board to exercise its judgment regarding the most appropriate leadership structure for the Company and the Board at a given time. The Board’s discretion should not be unduly constrained in advance because the most appropriate leadership structure at any given time will depend on a variety of factors, including the leadership, skills and experience of each of the CEO, the independent Lead Director and the other members of the Board, as well as the needs of the business and other factors.

Merck & Co., Inc. 2023 Proxy Statement

|

|

The independent Directors evaluate our Board leadership structure at least annually. In connection with the Company’s CEO transition in 2021, when the Board unanimously elected Mr. Davis to succeed Kenneth C. Frazier as CEO, and Mr. Frazier’s retirement as Executive Chairman at the end of 2022, in particular, the independent Directors gave significant consideration to the Board’s leadership structure. During this period, the independent Lead Director led a process with his fellow Directors working closely with Mr. Davis and Mr. Frazier that found Mr. Davis to be an innovative leader with deep understanding of the Company and its industry and well-suited to serve as Chairman of the Board. Effective December 1, 2022, Mr. Davis was unanimously elected by the Board to serve as the Chairman.

Merck & Co., Inc. 2024 Proxy Statement

Corporate Governance Lead Director | ÷ ÷ ÷ ÷ | 13 |

As Chairman, Mr. Davis presides over meetings of the Board and shareholders and focuses on Board operations and governance matters. He serves as the liaison between the Board and management, working closely with the independent Lead Director. Mr. Davis is also in charge of the general supervision, direction and control of the business and affairs of the Company subject to the Board’s overall oversight. The Board meets in executive session without Mr. Davis at each regular Board meeting. During these executive sessions led by Mr. Glocer as independent Lead Director, the Directors discuss topics such as the Board’s leadership structure, succession planning for the CEO and key management positions, and points of follow-up with management on strategic issues. The Board believes that having Mr. Davis serve as Chairman and CEO adds strategic and operational perspective to the Chairman role because he can draw on his detailed institutional knowledge of the Company and industry experience, while atexperience. At the same time, havingthere is strong independent oversight with Mr. Glocer as independent Lead Director vested with key duties and responsibilities and four independent Board committees chaired by independent Directors. Mr. Glocer can communicate with Mr. Davis between meetings and act as a “sounding board” and advisor and is also vested with key duties and responsibilities as discussed below.

Lead Director

Merck’s independent Lead Director is appointedAppointed by the independent members of the Board of Directors, to a three-year term. Thethe position of Lead Director has a clear mandate and significant authority and responsibilities set forth in the Policies of the Board, including:Board. These include:

Board Meetings and Executive Sessions | • The authority to call meetings of the independent members of the Board.

• Presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent members of the Board. | |

Communicating with

| • Serving as the principal liaison on Board-wide issues between the independent members of the Board and the Chairman and CEO. | |

Agendas | • Approving meeting agendas and information sent to the Board, including supporting material for meetings. | |

Meeting Schedules | • Approving meeting schedules to ensure there is sufficient time for discussion of all agenda items. | |

Communicating with Shareholders and Stakeholders | • Being available for consultation and direct communication with major shareholders, as appropriate.

• Serving as a liaison between the Board and shareholders on investor matters. | |

Board Performance Evaluation | • Leading the annual performance evaluation of the Board. | |

Chairman and CEO Performance Evaluations | • Leading the annual performance evaluation of the Chairman and CEO. | |

CEO Succession | • Leading the CEO succession planning process. | |

Merck & Co., Inc. 2023 Proxy Statement

|

|

As further described below,Each of the Board’s four standing committees each of which is composed solely of independent Directors,Directors. As further described below, each of these committees also playplays an active role in the Board’s leadership structure. The independent chairs of each of these committees provide strong leadership to guide the important work of the Board. They work with the Company’s senior executives to ensure the committees are discussing key strategic risks and opportunities of the Company. The Board believes the Company and its shareholders are well-served by the current leadership structure for all the foregoing reasons.

Merck & Co., Inc. 2024 Proxy Statement

| 14 | ç ç ç ç | Corporate Governance Board Meetings and Committees |

Board Meetings and Committees

In

The independent Directors of the Board met in |

All Directors attended at least 75% of the meetings of the Board and of the committees on which they served in |

The Board of Directors has four standing committees, each of which is made up solely of independent Directors: Audit Committee; C&MD Committee; Governance Committee; and Research Committee. In addition, the Board from time to time establishes special purpose committees. All of ourthe standing committees are governed by Board-approved charters, which are available on our website at www.merck.com/company-overview/leadership/board-of-directors/. The committees evaluate their performance and review their charters annually. Additional information about the committees is provided below. As a non-independent director, Mr. Davis is not a member of any Board committee, but may participate in meetings at the request of the committees.

Merck & Co., Inc. 20232024 Proxy Statement

Corporate Governance Board Meetings and Committees | ÷ ÷ ÷ ÷ | 15 |

Audit Committee

|

|

| Pamela J. Craig Chair | Overview

The Audit Committee oversees our accounting and financial reporting processes, internal controls and audits and consults with management, the internal auditors, and the independent auditors on, among other items, matters related to the annual audit, the published financial statements and the accounting principles applied. The Audit Committee has established policies and procedures for the pre-approval of all services provided by the independent auditors (as described on page

The Audit Committee’s Report is included on page

The Primary Functions of this Committee are to:

• Oversee the Company’s accounting and financial reporting processes, internal controls and audits;

• Appoint, evaluate and retain, and maintain direct responsibility for the compensation, termination and oversight of, the Company’s independent auditors, including evaluating their qualification, performance, and independence;

• Oversee the Company’s compliance with legal & regulatory requirements, including monitoring compliance with the Foreign Corrupt Practices Act and the Company’s policies on ethical business practices and reporting on these items to the Board;

• Establish procedures for the receipt, retention and treatment, on a confidential basis, of

• Oversee the Enterprise Risk Management process;

• Regularly meet with the Chief Information Officer regarding the Company’s information technology and have primary responsibility for overseeing the Company’s cybersecurity risk management program; and

• Review any significant issues concerning litigation and contingencies with management, counsel, and the independent public accountants. | |||||||

|

Other Members Douglas M. Baker, Jr. Stephen L. Mayo, Ph.D. Paul B. Rothman, M.D. Christine E. Seidman, M.D. Kathy J. Warden

| ||||||||

Number of Meetings in 9

| |||||||||

Financial Experts on Audit Committee

The Board has determined that each of Mr. Baker, Ms. Craig and Ms. Warden is an “audit committee financial expert” as defined by the SEC and has accounting or related financial management expertise as required by NYSE Corporate Governance Listing Standards.

| |||||||||

(1) Mr. Baker was appointed to the Audit Committee as of March 27, 2023. He previously served on the C&MD Committee.

Compensation and Management Development Committee

|

|

| Patricia F. Russo Chair | Overview

The C&MD Committee annually reviews and approves corporate goals and objectives relevant to the compensation opportunity for the Company’s executive officers, including the

The C&MD Committee Report is included on page

The Primary Functions of this Committee are to:

• Establish and maintain a competitive portfolio of fair and equitable compensation and benefits policies, practices and programs designed to attract, engage and retain a workforce that helps the Company achieve immediate and long-term success;

• Discharge the Board’s responsibilities for compensating our officers;

• Oversee/monitor – The competence and qualifications of our executive officers, – Officer succession, – The soundness of the organizational structure, – The Company’s programs, policies and practices related to its management of human – Other related matters necessary to ensure the effective management of the business; and

• Review the Compensation Discussion and Analysis for inclusion in our proxy statement. | |||||||

|

Other Members Mary Ellen Coe Thomas H. Glocer Risa J. Lavizzo-Mourey, M.D. Inge G. Thulin Peter C.

| ||||||||

Number of Meetings in

| |||||||||

Compensation and Management Development Committee Interlocks and Insider Participation

There were no C&MD Committee interlocks or insider (employee) participation during

| |||||||||

(1)Ms. Coe was appointed to Mr. Wendell is retiring from the C&MD CommitteeBoard effective as of March 27, 2023. She previously served on the Audit Committee.2024 Annual Meeting.

Merck & Co., Inc. 20232024 Proxy Statement

| 16 |

ç ç ç |

Corporate Governance Board Meetings and Committees |

Governance Committee

|

|

| Thomas H. Glocer Chair | Lead Director

| Overview

The Governance Committee oversees the Company’s corporate governance, including the practices, policies and procedures of the Board and its committees. Further, the Governance Committee annually reviews the size, structure and needs of the Board and Board committees, reviews possible candidates for the Board and recommends Director nominees to the Board for approval. The details of the review process and assessment of candidates are described under “Board Succession Planning, Criteria for Board Membership, and Director Nomination Process” beginning on page

The Primary Functions of this Committee are to:

• Coordinate an annual evaluation of Board performance, and review Board compensation, related person transactions and

• Oversee the Board’s Incumbent Director Resignation Policy;

• Review the Company’s Good Manufacturing Practice compliance, including with respect to internal and external manufacturing as well as internal and external audits; worker safety practices; and privacy policies and practices;

• Review social, political and economic trends that affect our business; review the positions and strategies we pursue to influence public policy; and

• Assist the Board in its oversight of the Company’s | |||||||

|

Other Members Douglas M. Baker, Jr. Pamela J. Craig Patricia F. Russo Inge G. Thulin Kathy J. Warden

| ||||||||

Number of Meetings in 4

| |||||||||

| |||||||||

Research Committee

|

|

| Paul B. Rothman, M.D. Chair | Overview

The Research Committee oversees the overall strategy, direction and effectiveness of the Company’s operations for the research and development of pharmaceutical products and vaccines. As part of this oversight, the Research Committee focuses on a variety of areas, including drug and vaccine discovery, licensing and development strategies, decision-making procedures and outcomes, as well as processes and procedures for identifying, evaluating and capitalizing on cutting edge scientific developments and advancements and enabling technologies.

The Primary Functions of this Committee are to:

• Identify areas and activities that are critical to the success of our product and vaccine discovery, development and licensing efforts and evaluate the effectiveness of our strategies and operations in those areas;

• Keep the Board apprised of this evaluation process and findings and make appropriate recommendations to the President of Merck Research Laboratories and to the Board on modifications of strategies and operations; and

• Assist the Board in its oversight responsibilities to ensure compliance with the highest standards of scientific integrity in the conduct of Merck research and development. | |||||||

|

Other Members Mary Ellen Coe Risa J. Lavizzo-Mourey, M.D. Stephen L. Mayo, Ph.D. Christine E. Seidman, M.D. Peter C. Wendell(1)

| ||||||||

Number of Meetings in

| |||||||||

(1) Mr. Wendell is retiring from the Board effective as of the 2024 Annual Meeting.

Merck & Co., Inc. 20232024 Proxy Statement

Corporate Governance Board’s Role in Strategic Planning | ÷ ÷ ÷ ÷ | 17 |

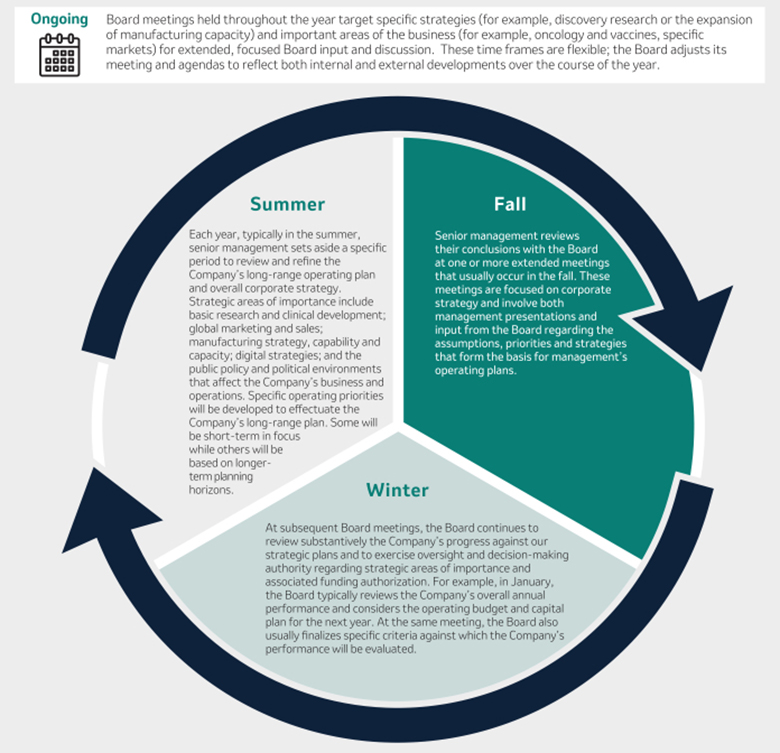

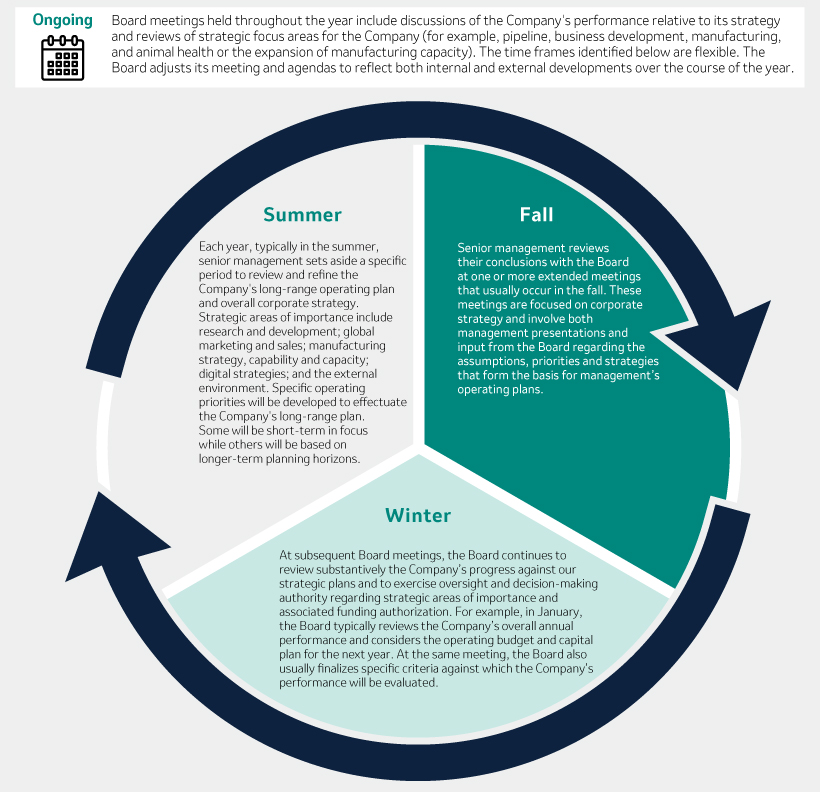

Board’s Role in Strategic Planning

The Board — acting both as a whole and through its four standing committees — is fully engaged and involved in the Company’s strategic planning process. All of our Directors have an obligation to keep informed about the Company’s business and strategies, so they can provide guidance to management in formulating and developing plans and knowledgeably exercise their decision-making authority on matters of importance to the Company.

The Board’s oversight and guidance are inextricably linked to the development and review of the Company’s strategic plan. By exercising sound and independent business judgment on the strategic issues that are important to the Company’s business, the Board facilitates Merck’s long-term success.

Our Strategic Planning Cycle

Merck & Co., Inc. 20232024 Proxy Statement

| 18 |

ç ç ç |

Corporate Governance Risk Oversight |

Risk Oversight

Overseeing risk is an important component of the Board’s engagement on strategic planning. The Board’s approach to overseeing risk management leverages the Board’s leadership structure and ensures the Board oversees risk through both a Company-wide approach and specific areas of competency. A summary of this risk oversight approach follows:

Board of Directors

Oversees risk through Company-wide Enterprise Risk Management (“ERM”) process and functioning of Board Committees. |

Audit Committee

Responsibility for reviewing the ERM process to ensure it is robust and functioning effectively.

Primary responsibility for overseeing the Company’s cybersecurity risk management

Oversees risk relating to finance, business integrity and internal controls over financial reporting through its interactions with the Chief Financial Officer, Chief Compliance Officer, Controller and the head of internal audit.

| |||

Compensation and Management Development Committee

Evaluates relationships between risk and reward as it relates to our executive compensation program.

When setting incentive plan targets each year, the C&MD Committee is aware of the risk associated with drug pricing, among other things, and ensures our plans do not incentivize risky behavior in order to meet targets.

Oversees the Company’s programs, policies and practices related to its management of human capital resources.

| ||||

Management

Identification, assessment and management of risk through Company-wide ERM process. | ||||

Governance Committee

Oversees the Company’s corporate governance, including the practices, policies and procedures of the Board and its committees, considers the size, structure and needs of the Board, reviews possible candidates for the Board, and recommends Director nominees to the Board for approval.

Plays a role in compliance oversight, including in the areas of manufacturing quality, privacy, and worker safety.

Assists the Board in its | ||||

Research Committee

Oversees overall strategy, direction and effectiveness of the Company’s research and development operations.

|

The ERM process allows for full Board oversight of the most significant risks facing the Company and was established to ensure a complete Company-wide approach to evaluating risk over six distinct but overlapping risk areas:

Responsibility and Reputation | Risks that may impact the well-being of the Company, its employees, customers, patients, communities or reputation | ||

Strategy | Macro risks that may impact our ability to achieve long-term business objectives | ||

Operations | Risks in operations and cybersecurity that may impact our ability to achieve business objectives | ||

Compliance | Risks related to compliance with laws, regulations and Company values, ethics and policies | ||

Reporting | Risks to maintaining accurate financial statements and timely, complete financial disclosures | ||

Safety | Risks to employee, patient or community health and safety | ||

Merck & Co., Inc. 20232024 Proxy Statement

Corporate Governance Risk Oversight | ÷ ÷ ÷ ÷ | 19 |

Our ERM process seeks to identify emerging risks and address them appropriately to limit negative consequences to the Company and the data it maintains. Its goal is to provide an ongoing review, implemented across the Company and aligned to Company values and ethics, to identify and assess risk and to monitor risk and agreed-upon mitigating action. Furthermore, if a risk transforms into an incident, the ERM process ensures that effective response and business continuity plans are in place. If the ERM process identifies a material risk, it will be elevated through the CEO and the Executive Team to the full Board for consideration. Through the ERM process, each Board committee oversees specific areas of risk relevant to the committee through direct interactions with the CEO, members of the Company’s Executive Team and the heads of business divisions, compliance and corporate functions. A committee may address risks directly with management or, where appropriate, may elevate a risk for consideration by the full Board or another Board committee. The Board committees also oversee risk based on their specific areas of competency. Additional detail with respect to certain key areas of oversight are provided below.

Cybersecurity and Privacy

As our Company becomesdiscussed in more dependentdetail in the 2023 10-K, the Company’s cybersecurity measures are primarily focused on ensuring the security and protection of its information technology systems and data,data. The Audit Committee and the need for a robustBoard receive periodic reports that include updates on the Company’s cybersecurity privacy,risks and technology riskthreats, the status of projects intended to strengthen its information security systems, assessments of the information security program (including remediation, mitigation, and management of identified vulnerabilities), and the emerging threat landscape. The Company’s information security program is increasingly critical. We have developedregularly evaluated by internal and implemented a comprehensive program designedexternal consultants and auditors with the results of those reviews reported to protect the confidentiality of sensitive information, ensure the integrity of critical data and automated processes, and safeguard the availability of our information technology capabilities.

Cybersecurity has been an area ofsenior management attention for over two decades and we have aligned our cybersecurity program to the National Institute of Standards and Technology (NIST) Cybersecurity Framework and the Payment Card Industry Data Security Standard (PCI-DSS). We have implemented appropriate policies, processes, and technology to reduce the likelihood or impact of a breach and have cyber insurance. We have an employee awareness program to regularly educate our workforce on the cybersecurity risks they face and how they can operate safely. We regularly assess our cybersecurity capabilities using third party security firms.Audit Committee.

We have also developed and continually evolve our Global Privacy Program to promote organizational accountability for privacy, data governance, and data protection across our business and with our collaborative partners and suppliers. The program helps us uphold our commitment to data security and privacy, including maintaining 100% compliance to regulatory requirements for active incident monitoring, risk/harm analysis, and on-time notification of data breaches. Our commitment applies not only to our Company’s information, but also to the information entrusted to us by others. We were the first company in the world to obtain regulatory certification in the European Union for Binding Corporate Rules based in part on our existing Asia Pacific Economic Cooperation Cross Border Privacy Rules certification.

We are aware that we must continuously evolve our controls to address new threats, adhere to changing laws and standards, and reduce the risk associated with the introduction of new, innovative technology. While everyone at the Company plays a part in information security, cybersecurity, and data privacy, oversight responsibility is shared by the Board, its committees, and management.

Responsible Party | Oversight Area for Cybersecurity and Privacy Matters | |

Board | Participates in regular reviews and discussions dedicated to the Company’s risks related to the protection of our data and systems including cybersecurity and privacy. | |

Audit Committee |

| |

Governance | Responsible for oversight in the area of privacy and receives periodic updates regarding the Company’s Global Privacy Program. | |

Management | Responsible for implementing and managing the Company’s framework for assessing, prioritizing and mitigating cybersecurity risk. A Chief Information Security Officer manages the Company’s Information Security Program with a group responsible for leading enterprise-wide cybersecurity risk management, strategy, policy, standards, architecture and processes. Manages the Company’s Global Privacy Program. Responds to incidents and issues in a timely manner. Provides periodic updates to the Board and or its committees, as applicable. |

Merck & Co., Inc. 20232024 Proxy Statement

| 20 |

ç ç ç |

Corporate Governance

|

Environmental, Social and Governance (“ESG”) MattersSustainability

The Board of Directors and its Committees are responsible and accountable for overseeing the Company’s ESGsustainability matters, whileand management is responsible for reviewing, refining, and implementing the long-term ESGsustainability strategy and for updating the Board and its Committees.

Responsible Party | Key Oversight | |

Board | The | |

Governance | This Committee monitors and assists the Board in | |

C&MD Committee | This Committee assists the Board with its oversight of human capital management, including the Company’s programs, policies, and practices related to talent management, culture, diversity, equity and inclusion. This includes maintaining fair hiring and promotion practices, and a commitment to sustain equitable pay | |

Audit Committee | This Committee monitors compliance with the Company’s policies on ethical business practices and oversees any sustainability bonds the Company may issue. | |

Research Committee | This Committee monitors compliance with the highest standards of scientific integrity in the conduct of the Company’s research and development. | |

Management | Our Executive Team and senior management are responsible for reviewing, refining and implementing our Company’s long-term

By ensuring ongoing business engagement ownership and accountability with regard to |

For more information about our approach to ESG,sustainability, please visit our 2021/2022 ESG Progress2022/2023 Impact Report at https://www.merck.com/company-overview/esg/sustainability/.

Providing Access to Health to Patients Around the World

We are continuing to make progress in ESG areas that matter most to our Company and our stakeholders which include Access to Health, Employees, Environmental Sustainability, and Ethics & Values. Of these four priorities, Access to Health is central to our purpose as a research-intensive biopharmaceutical company, helping to create value for our stakeholders and improve the lives of patients around the world. Our approach is guided by our Access to Health Guiding Principles, focused in four main areas:

Discovery and invention

Availability

Affordability

Strengthening health care systems and addressing inequity

Merck & Co., Inc. 2023 Proxy Statement

|

|

Our Access to Health Guiding Principles (the “Principles”) guide our work in addressing global burdens of disease with our products and pipeline. We aim to make a safe global supply of quality medicines and vaccines available to the greatest number of patients today while meeting the needs of patients in the future. The Principles inform our efforts to address barriers to accessing our medicines and vaccines, as well as the systemic barriers to health care around the world.

Discovery and Invention

Pursuing the most promising science, we discover and invent medicines and vaccines that address vital global health needs where we can have the greatest impact, now and in the future.

Availability

Making available a reliable and safe global supply of quality medicines and vaccines, we invest in solutions to enable timely access to our products, in a responsible and sustainable manner.

Affordability

Grounded in a deliberate systematic approach, we develop, test, and implement innovative solutions that address barriers to access and affordability of our medicines and vaccines.

Strengthening Systems and Addressing Inequity

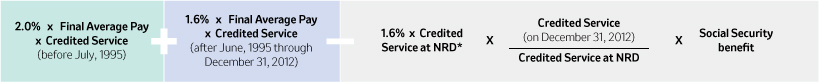

Applying our expertise to address systemic barriers to access to health, we believe we can make the strongest contributions to health systems, communities and our patients around the world.